[ad_1]

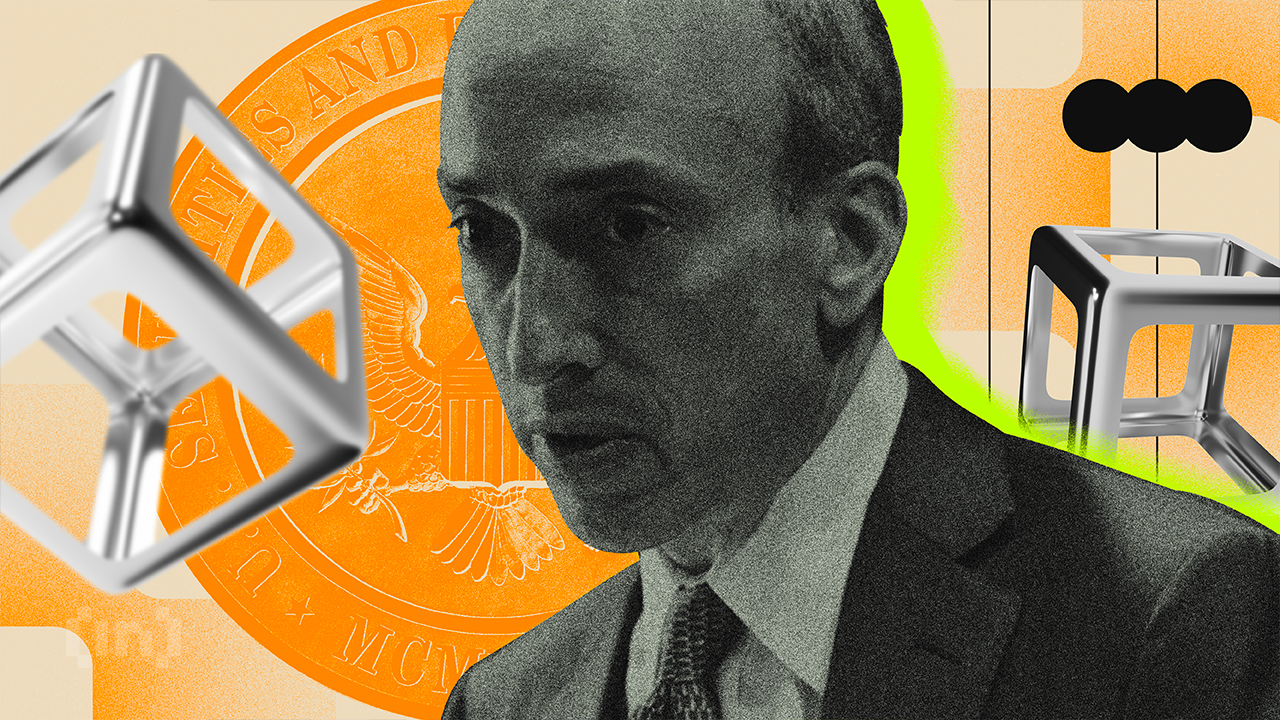

The Securities and Exchange Commission (SEC) has extended the review period for the Fidelity spot Ethereum ETF. Initially set for a decision by January 20, 2024, the SEC has pushed the deadline to March 5, 2024.

This delay affects the proposal by Cboe BZX Exchange to list and trade shares of the Fidelity spot Ethereum ETF under BZX Rule 14.11(e)(4), which relates to Commodity-Based Trust Shares.

Spot Ethereum ETF Decision Delayed

If approved, the Fidelity spot Ethereum ETF would mark a noteworthy step in integrating Ethereum-based investments into mainstream financial markets. Ethereum, known for its versatile blockchain technology, has garnered significant attention from investors and tech enthusiasts.

This proposed fund aims to offer a regulated investment vehicle for Ethereum, diversifying investment options in the cryptocurrency space. Still, Raoul Pal, CEO of Real Vision, believes spot Ethereum ETFs will not gain institutional demand.

“A lot of the institutions would prefer to own ETH itself because then they can stake it and get yield. If you don’t give them yield, some asset manager who launches the ETF is going to get rich. [For example,] BlackRock will make all the money because they’ll get the ETH staking yield and they don’t give it to the to the ETF holders,” Pal said.

The SEC’s decision to extend the review period underscores the regulatory body’s cautious approach toward digital assets. The Commission aims to thoroughly evaluate the implications of introducing such a fund into the market. Therefore, it will consider aspects like investor protection and market integrity.

This delay provides the SEC with additional time to assess the proposed rule change and address any issues that may arise.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link

Be the first to comment