[ad_1]

Ever wondered who’s behind the massive Bitcoin price swings? The answer lies in a group of individuals or entities known as Bitcoin whales.

These individuals or organizations own large amounts of Bitcoin, allowing them to influence market trends significantly.

Characteristics of Bitcoin Whales

Two main features define a Bitcoin whale:

Wealth Concentration

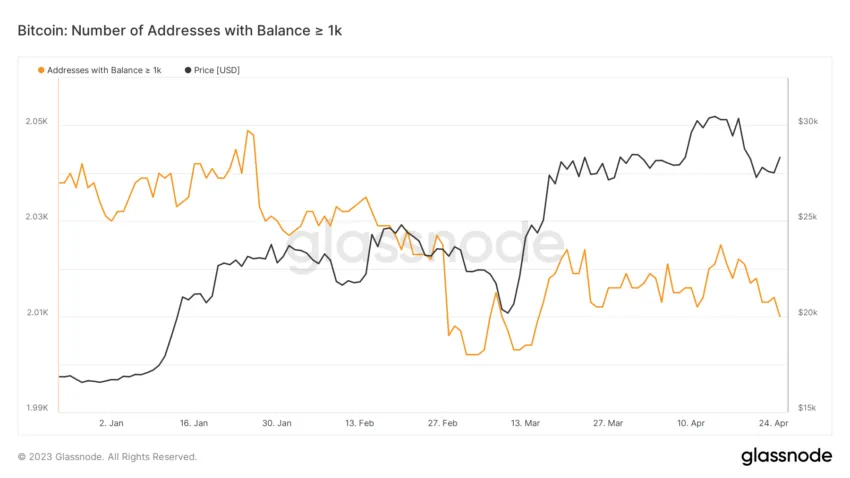

Whales typically own a large number of BTC tokens, giving them the power to impact the market through their trading activities.

In some cases, a single whale may own thousands of BTC tokens, translating to millions of dollars in value.

Anonymity

Bitcoin whales often maintain a low profile and prefer anonymity. This makes it challenging to identify and track their activities, allowing them to maneuver the market easily.

How Whales Influence Prices

Whales can cause significant price swings in Bitcoin through two main methods:

Large Buy and Sell Orders

Since whales hold significant amounts of Bitcoin, their large buy and sell orders can lead to substantial price fluctuations.

For instance, a whale placing a massive sell order may lead to a sudden drop in the Bitcoin price, while a large buy order can cause the BTC price to spike.

Market Manipulation

Market manipulation is another tactic employed by whales to influence Bitcoin prices. Some common manipulation tactics include:

Pump and Dump Schemes

In a pump-and-dump scheme, whales buy large quantities of Bitcoin, driving up the price. Once the price reaches a certain threshold, they quickly sell off their holdings, causing the price to plummet.

This allows them to profit from the price surge while leaving unsuspecting investors with losses.

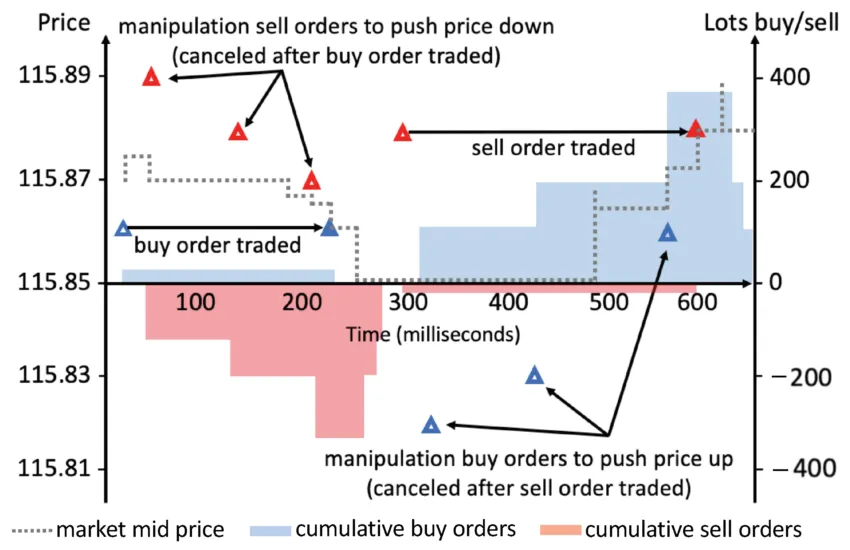

Spoofing

Spoofing involves placing fake buy or sell orders to create an illusion of high demand or supply. Whales can use this tactic to manipulate the market sentiment and make other traders act in their favor.

Once the desired price movement is achieved, they cancel their fake orders and profit from the market reaction.

Impacts of Bitcoin Whale Activity on the Market

Whale activity can have several effects on the Bitcoin price, such as:

Volatility

The actions of whales can result in sudden and dramatic price swings, leading to increased market volatility. This can create both opportunities and risks for traders and investors.

Market Confidence

Whale-induced price swings can negatively impact market confidence, especially when manipulation tactics are involved. This can lead to a reluctance to invest in Bitcoin, affecting its long-term growth potential.

How to Protect from Whale-Induced Bitcoin Price Swings

While it’s impossible to control the actions of whales, there are steps investors can take to protect themselves from their influence:

Diversification

Spreading investments across multiple cryptocurrencies and other asset classes can help mitigate the risks associated with whale-induced Bitcoin price swings. By diversifying portfolios, investors reduce the impact of any single market event.

Regular Monitoring and Analysis

Keeping a close eye on market trends and news can help investors identify potential whale activity. Analyzing market data, such as trading volumes and order books, can also provide insights into whale movements.

Long-Term Investment Strategy

Adopting a long-term investment approach can help shield investors from short-term price fluctuations caused by Bitcoin whales. By focusing on the long-term growth potential of Bitcoin, investors may be less affected by temporary price swings.

Summing All Up

Whales wield considerable power in the cryptocurrency market, and their actions can lead to significant price swings.

By understanding their tactics and employing protective measures, investors can minimize the impact of whale-induced price fluctuations on their investments.

FAQs

A Bitcoin whale is an individual or organization that owns a large amount of Bitcoin, giving them the power to significantly influence market trends.

Bitcoin whales can cause price fluctuations through large buy and sell orders and market manipulation tactics, such as pump and dump schemes and spoofing.

You can protect yourself by diversifying your investments, regularly monitoring market trends and data, and adopting a long-term investment strategy.

While it’s difficult to definitively identify Bitcoin whales, monitoring market data and trends can provide insights into their activities.

Not necessarily. While some whales engage in market manipulation, others may simply be long-term investors who have accumulated a large amount of Bitcoin.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link

Be the first to comment