[ad_1]

Ethereum is a decentralized, open-source blockchain platform with smart contract functionality, which has become the second-largest cryptocurrency by market capitalization. Since its inception, it has attracted a wide range of investors, developers, and traders due to its innovative technology and potential for growth. However, like any financial market, the ecosystem can be vulnerable to Ethereum price manipulation.

Despite growing concerns, there are ways to learn to recognize Ethereum price manipulation signs and learn how to protect investments.

The Issue of Ethereum Price Manipulation

How Price Manipulation Occurs

Price manipulation is a deceptive practice where malicious actors intentionally influence the market price of an asset to their advantage. These actors can achieve this by using various strategies, including spoofing, wash trading, and pumping and dumping.

The Impact of Price Manipulation

Price manipulation can lead to distorted market valuations, investor losses, and reduced confidence in the overall ecosystem. It is crucial to be aware of the signs and effects of price manipulation and how to protect oneself from falling victim to it.

Signs of Ethereum Price Manipulation

Sudden Price Movements

One indication of price manipulation is erratic and sudden price movements that are inconsistent with market trends. These can be short-term spikes or drops that seem illogical based on recent news or developments in the Ethereum ecosystem.

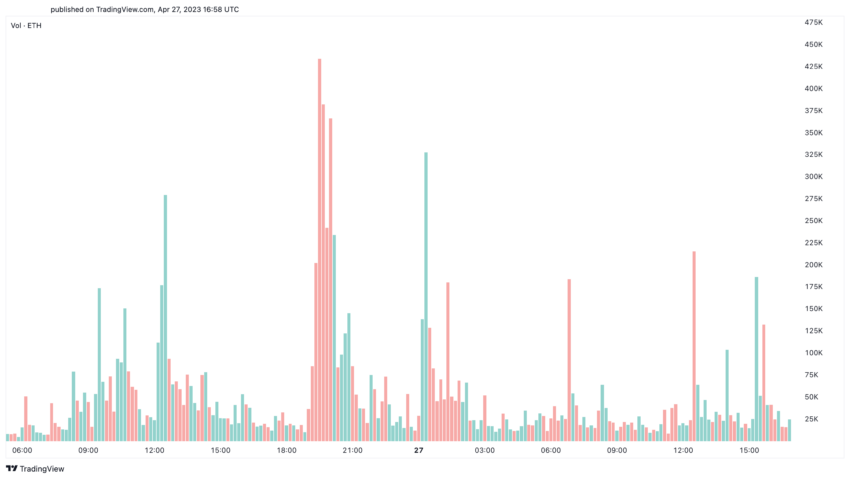

Concentrated Trading Volume

Another sign is a sudden surge in trading volume that is concentrated among a small group of traders or trading platforms. This could indicate that a coordinated effort is being made to manipulate the price of Ethereum.

Social Media Influence

Social media can also be used to manipulate prices by spreading misinformation or false news to create hype around a particular asset. In the case of Ethereum, unscrupulous individuals may use social media platforms to spread rumors or fake news to drive up the price, only to sell once the price reaches their desired level.

The Effects of Price Manipulation on Ethereum

Market Sentiment and Trust

Price manipulation can damage the overall market sentiment and trust in Ethereum, as investors may become wary of the ecosystem’s legitimacy. This can lead to reduced participation in the market and hinder the growth and adoption of the platform.

Losses for Investors

Investors who are unaware of price manipulation strategies may fall victim to these schemes and suffer significant losses. It is essential to be vigilant and recognize the signs of manipulation to avoid falling into these traps.

Regulatory Repercussions

Price manipulation can also attract the attention of regulatory bodies, who may take steps to impose stricter rules and regulations on the Ethereum ecosystem. While regulation can help protect investors, it may also hinder innovation and development within the blockchain industry.

How to Protect from Price Manipulation

Diversification

One effective way investors can protect themselves from the effects of price manipulation is through diversification. By investing in a range of assets, including various cryptocurrencies and traditional investments, investors can reduce the impact of any single market event on their portfolio.

Research and Due Diligence

Conducting thorough research and due diligence is essential when investing in any asset, including Ethereum. This can help investors better understand the asset’s fundamentals and allow them to recognize the signs of price manipulation more easily.

Trading Discipline

Maintaining trading discipline is also crucial in protecting from price manipulation. This involves setting clear entry and exit points for trades and managing risk using stop-loss orders and appropriately positioned sizing. Avoid letting emotions dictate trading decisions, as this can make investors more susceptible to manipulation tactics.

Summing All Up

Ethereum price manipulation is a cause for concern. It can lead to distorted market valuations, investor losses, and reduced confidence in the ecosystem.

By being aware of the signs and effects of price manipulation and taking steps to protect against it, investors can minimize their exposure to these risks. As Ethereum continues to grow and evolve, it is crucial to remain vigilant and informed to safeguard investments.

Ethereum is a decentralized, open-source blockchain platform with smart contract functionality. It is the second-largest cryptocurrency by market capitalization.

Price manipulation is a deceptive practice where malicious actors intentionally influence the market price of an asset, such as Ethereum, for their advantage.

Protecting yourself from price manipulation involves diversification, conducting thorough research and due diligence, and maintaining trading discipline.

Price manipulation can damage market sentiment and trust, lead to losses for investors, and attract regulatory repercussions.

Being aware of price manipulation can help investors recognize the signs and effects of these deceptive practices, allowing them to take appropriate steps to protect their investments.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link

Be the first to comment