[ad_1]

The cryptocurrency industry has a tendency to consistently astound investors and market participants alike. Yet, one cannot help but notice an apparent discrepancy between the assessment and the budding promise of Spot Bitcoin ETFs (Exchange-Traded Funds).

Leading analysts across the board argue that the crypto market dramatically undervalues the bullish potential these financial instruments possess.

The Market Is “Wrong” About Bitcoin ETFs

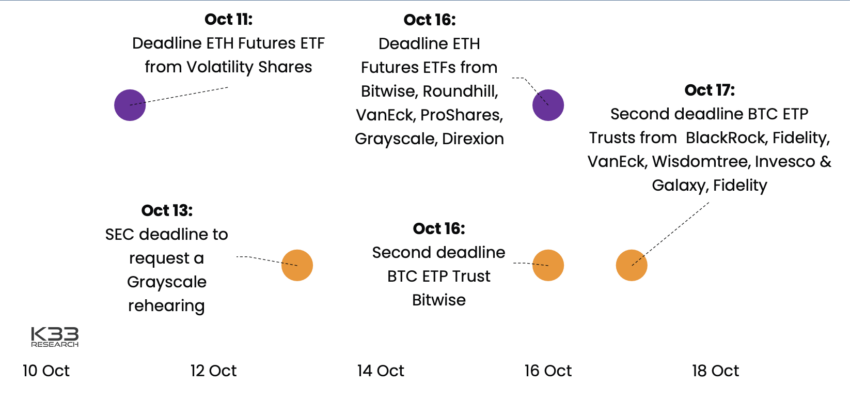

K33 Research recently highlighted the significant disconnect in market sentiment and the increased prospects of a Spot Bitcoin ETF approval.

Senior Analyst Vetle Lunde, alongside Vice President Anders Helseth, accentuated that despite the market downturn, many have missed the magnitude of this historic event. They believe that in the long term, the scales will tilt in favor of the bulls.

“The market dramatically underestimates the impact of US BTC ETFs and, in extension, futures-based ETH ETFs. In September, few catalysts await, offering a solid opportunity for strategic positioning ahead of an October packed with market-moving events. I favor a mix of increased ETH exposure and conservatively leveraged long exposure in BTC,” Lunde and Helseth affirmed.

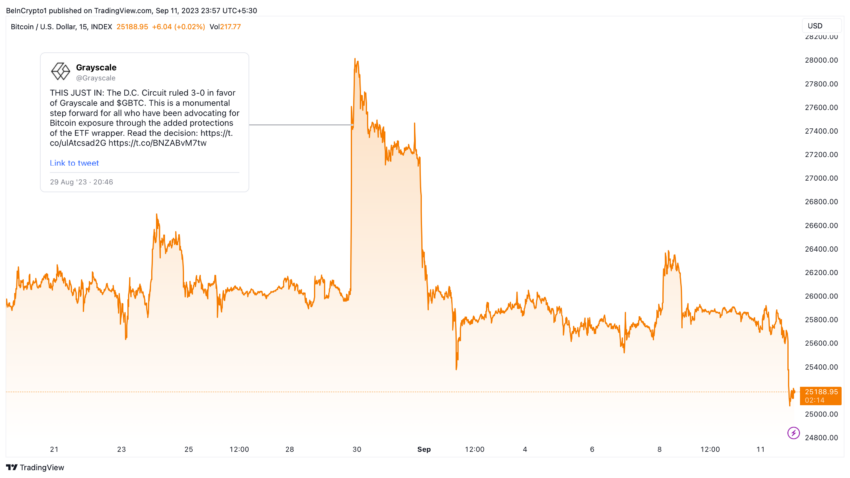

Delving deeper into the complexities of the situation, Grayscale’s triumphant legal face-off against the US Securities and Exchange Commission (SEC) saw a court ruling that severely criticized the regulator’s rationale for rejecting Spot Bitcoin ETF applications as “arbitrary and capricious.”

Although Bitcoin has essentially relinquished its gains, Lunde and Helseth maintain that a Spot Bitcoin ETF’s approval would trigger colossal financial inflows, exponentially heightening buying pressure.

“The last three months have greatly enhanced the odds of an ETF approval, yet prices are far from reflecting this… I firmly believe the market is wrong. This is, by all accounts, a buyer’s market, and it is reckless not to aggressively accumulate BTC at current levels,” Lunde and Helseth added.

Read more: How To Buy Bitcoin Anonymously (Without ID)

Time to Start Building a Crypto Portfolio

Ilya Volkov, CEO of YouHodler, told BeInCrypto that he also believes “it is a great time to enter the market.” He emphasized that investors have yet to fully appreciate Grayscale’s victory against the SEC, suggesting a bullish long-term outlook.

“Right now, my advice is to enter the market and start building a portfolio. We are still in the early stages of growth – if we compare crypto to the early days of the stock market. We already know how beneficial it was to be in the stock market in those early stages so, if you are already participating in the market, good for you. Keep going. Try intraday trading or dollar-cost average (DCA) to build your portfolio,” Volkov affirmed.

Read more: 11 Best Crypto Portfolio Trackers in 2023

Still, the former board member at Libertex Group underscored the need for patience. Subsequently noting that the looming regulatory challenges could overshadow predictions by several Bloomberg analysts, who foresee a 75% likelihood of a Spot Bitcoin ETF endorsement.

“We need to be patient. The US needs to approve the Bitcoin ETF first. The market should not overload the SEC with all these applications. Give them a chance to adapt slowly. The government always moves slower than technological innovation so we should try to focus on one thing at a time,” Volkov affirmed.

Likewise, former SEC chair, Jay Clayton, emphasized that the increasing clarity surrounding Bitcoin’s identity, suggests that a Spot Bitcoin ETF approval is only a matter of time.

“It is clear that Bitcoin is not a security. It is clear that Bitcoin is something that retail investors want access to, institutional investors want access to, and, importantly, some of our most trusted providers who are fiduciaries or have duties of best interest want to provide this product to the retail public. So I think […] an approval is inevitable,” Clayton stated.

Could Ethereum Be Labeled Security?

The unfolding narrative around cryptocurrencies is not limited to Bitcoin. Ethereum, for instance, could overshadow Bitcoin’s performance in the coming months. Analysts suggest that Ethereum will capitalize on the momentum stemming from an anticipated futures-based ETF listing.

Drawing parallels, Bitcoin witnessed a 60% surge in the weeks preceding the debut of its futures-based ETF on October 19, 2021. The trajectory ETH might undertake could emulate this path.

Indeed, noteworthy financial institutions, such as JPMorgan and Bernstein, have reiterated the monumental impact on the broader crypto market.

“The crypto ETF opportunity will not stop at just Bitcoin, but will extend into multiple crypto assets. The industry push for an Ether Spot ETF follows immediately after, given ETH also has a similar market structure of a traded CME futures market and a spot market,” said Gautam Chhugani, Managing Director at Bernstein.

Still, Volkov cautions about the potential of the SEC classifying ETH as a security, which may not impede the approval of an Ethereum ETF.

“One could argue that the SEC will not approve an Ether ETF due to the stark difference between BTC and ETH. BTC is pure crypto, while ETH is a technology with many interconnected facets. Moreover, ETH could be considered a security. However, in my opinion, the SEC will ultimately have no choice but to approve it. Consider it like the law of the excluded middle. If the SEC approves a BTC ETF, it should do the same for ETH. If it considers ETH a security, the SEC should approve its ETF as well. Simply because ETFs are inherently designed for securities,” Volkov added.

Read more: The Full List of Cryptos Named Securities by the SEC

While the market awaits regulatory clarity, Volkov emphasized that the global crypto adoption invariably hinges on market maturity. Like all markets, cryptocurrency experiences a progression, starting with little to no regulation and marked volatility.

However, according to Volkov, markets often face a significant disruption, necessitating regulatory intervention. This intervention ushers in stability, leading to consistent and sustainable market trends.

Therefore, the comprehensive regulatory frameworks being developed underscore the seriousness with which authorities regard this technology.

“Regulators are still trying to figure out the terminology to define cryptocurrencies. But as soon as they do, that will be a big step forward. The turbulence we are experiencing will be over at some point. I do not see any single pivotal milestone changing that. It will be a slow, consistent trend of long-term adoption,” Volkov concluded.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

[ad_2]

Source link

Be the first to comment