[ad_1]

Changpeng Zhao, CEO of the world’s largest crypto exchange Binance, has responded to the scathing lawsuit against his firm by the U.S. Commodity Futures Trading Commission (CFTC).

On March 27, the CFTC unleashed a barrage of complaints against Binance and Changpeng Zhao in a lawsuit that accused him of insider trading and evading KYC (know-your-customer) controls.

A few hours later, the Binance boss responded to what he termed an “unexpected and disappointing civil complaint.”

His disappointment was exacerbated by the fact that the firm had been cooperating with U.S. regulators over the past two years.

“The complaint appears to contain an incomplete recitation of facts, and we do not agree with the characterization of many of the issues alleged in the complaint,” he stated.

Binance CEO Eats His Own Dog Food

Among the allegations was that Binance has traded on its own platform. Furthermore, the CFTC claimed that there were “approximately 300 ‘house accounts’ that are all directly or indirectly owned by Zhao.”

CZ stated that Binance.com “does not trade for profit or “manipulate” the market under any circumstances.” He added that company revenues are in crypto, so it needs to convert them from time to time to cover expenses in fiat or other cryptocurrencies:

“Personally, I have two accounts at Binance: one for Binance Card, one for my crypto holdings. I eat our own dog food and store my crypto on Binance.com. I also need to convert crypto from time-to-time to pay for my personal expenses or for the Card.”

“Eat your own dog food” is a colloquial expression that describes a company using its own products or services for its internal operations.

CZ also said that Binance has a 90-day no-day-trading rule for employees. This means that they are not allowed to sell a coin within 90 days of their most recent purchase or vice versa.

KYC Violation Accusations

Regarding accusations that the firm evaded KYC controls, he said that it was the first global (non-US) exchange for implementing a mandatory KYC program.

He added that Binance.com blocks U.S. users by nationality and IP address. However, the CFTC accused the exchange of encouraging U.S. traders to use VPNs (virtual private networks) to evade the block.

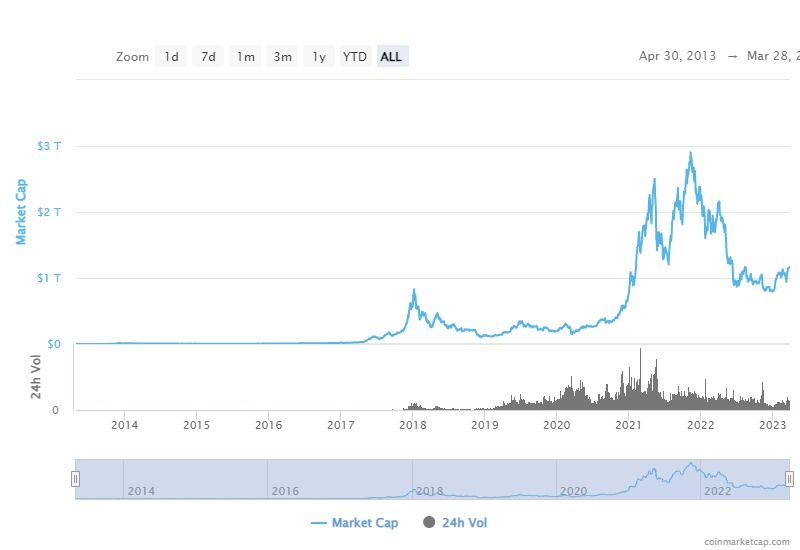

Markets have reacted badly to the news, with $30 billion leaving the space over the past 12 hours or so. As a result, the 2.6% decline has dropped total market capitalization to $1.17 trillion.

BNB has taken a 5.8% hit falling to $309 at the time of press.

On the bright side, a minor move such as this is not uncommon for markets, and things appear to have stabilized at current levels for the time being.

Disclaimer

BeInCrypto has reached out to company or individual involved in the story to get an official statement about the recent developments, but it has yet to hear back.

[ad_2]

Source link

Be the first to comment