[ad_1]

With a roughly 70% gain, Bitcoin is closing out its best quarter since the three months ending March 2021, when it surged 103%.

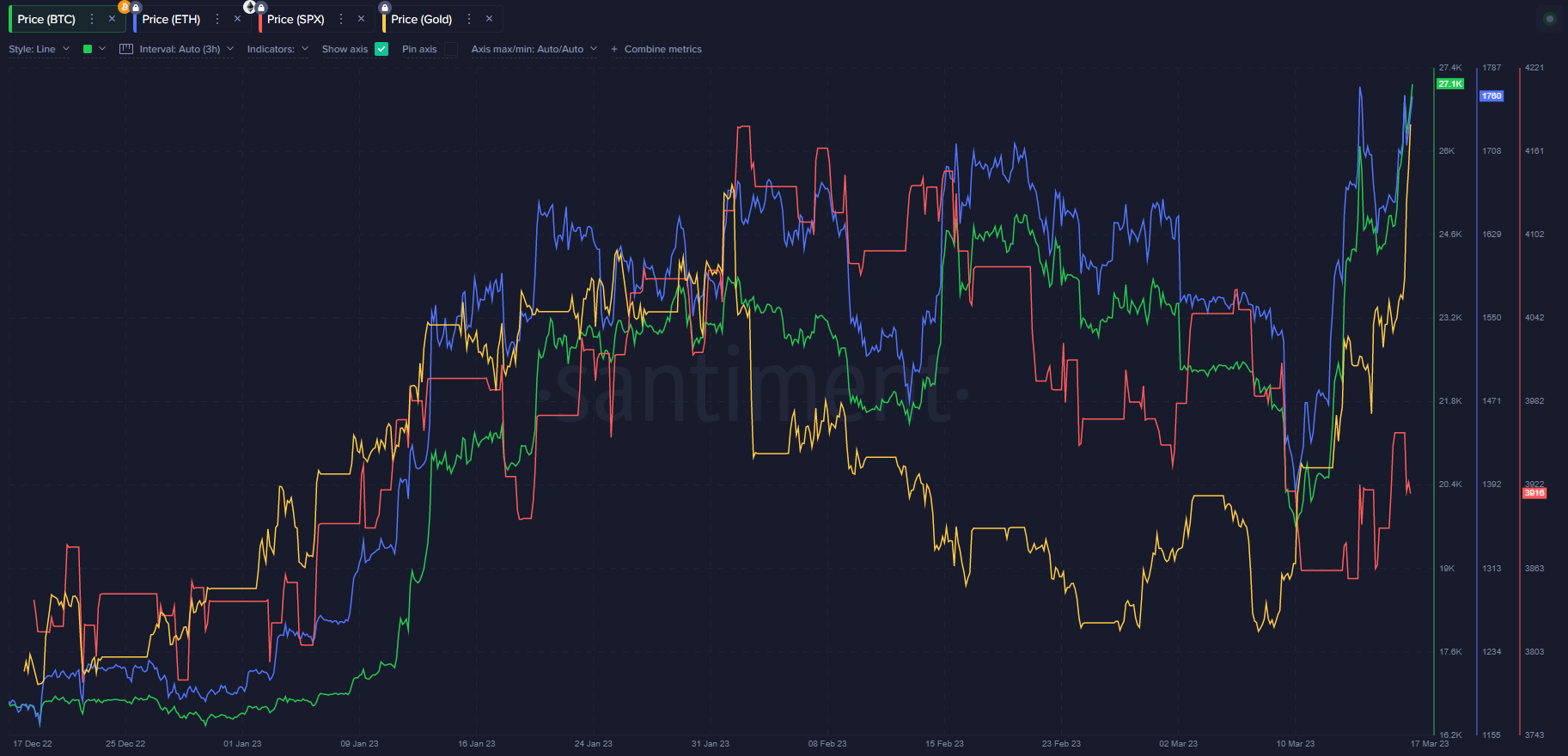

That vastly outstrips the S&P 500’s 5.5% year-to-date advance, the Nasdaq 100’s 19% uptick, and the iShares 20+ Year Treasury Bond ETF’s 5.3% jump.

BTC Finding Its Place

Bitcoin is set to close out the first fiscal quarter with its best three-month performance in nearly two years. Marking an extraordinary turnaround of fortunes as the top coin looks set to close Q2 2023 with roughly a 70% price increase.

Other asset classes, such as stocks, have been left behind in Bitcoin’s tracks. Bitcoin has vastly outpaced the current 5.5% of the 2023 performance that the S&P 500. Bitcoin has also gained over three times the amount that the Nasdaq 100 has in Q2 2023, with its 19% price gain.

The final quarter of 2022 proved challenging for Bitcoin, losing around 15% in value. Factors such as the poor macroeconomic environment, Terra (LUNA) crisis, and crypto contagion fears impacted Bitcoin’s overall performance throughout 2022.

This year Bitcoin has remained resilient. Despite the collapse of two major banks with links to cryptocurrencies, Silvergate and Signature Bank. The notion that the Federal Reserve (Fed) had to undergo “QE Light” and expand its balance sheet and add liquidity benefitted Bitcoin.

Recent indications that the Fed may be moving toward the end of its rate increase cycle have also been positive for Bitcoin. Even less dramatic rate hikes in Q2 2023 may underpin the top crypto’s value.

Bitcoin’s reaction to Binance has shown that the future of the asset is not dependent on just one exchange, which is encouraging to the industry as a whole.

One metric to keep a close eye on in Q2 2023 is the price correlation between Bitcoin and Gold.

The 30-day correlation between the two assets reached over 0.3 this month, its highest over 12 months. The ongoing bullish technical set-up for Gold certainly bodes well for further price gains in the yellow metal going forward.

Should Bitcoin retain this price correlation with Gold? More upside in Bitcoin seems likelier than not in the weeks ahead.

Total BTC Holders Gradually Climbs

Another very positive development for Bitcoin this quarter has been the sharp increase in Blockchain forensics platform Santiment’s Total Amount of Holders metric.

Since the start of Q1 2023, the Total Amount of Holders metric for Bitcoin has increased by over 2.15 million, to 45.74 million, making an increase of 5%.

Should we continue to see a rising trend in the total amount of Bitcoin holders in Q2 2023, it could easily translate into more gains ahead.

Bitcoin Price Prediction: Blasting Towards $34,000

The ongoing Golden Cross on the daily time frame indicates a buy signal for Bitcoin and the potential for further strong gains ahead.

A Golden Cross occurs when the 50-day moving average crosses over the 200-day moving average. The chart below depicts that Bitcoin is still in the early stages of a Golden-cross.

The last time a Golden Cross took place for Bitcoin was on September 14, 2021. The BTC/USD pair rallied from $46,000 to $69,000, gaining close to 50%.

Given that the current Golden Cross has yielded Bitcoin around 29%, it is possible that if BTC was to match the gains of the previous Golden Cross and gain a further 21%. Then a rally close to $34,000 is possible.

Still, if the bears take charge and Bitcoin price slips below the week’s lows so far, at $26,700, expect a larger drop toward $24,500 before they choose to cut their losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions.

[ad_2]

Source link

Be the first to comment