[ad_1]

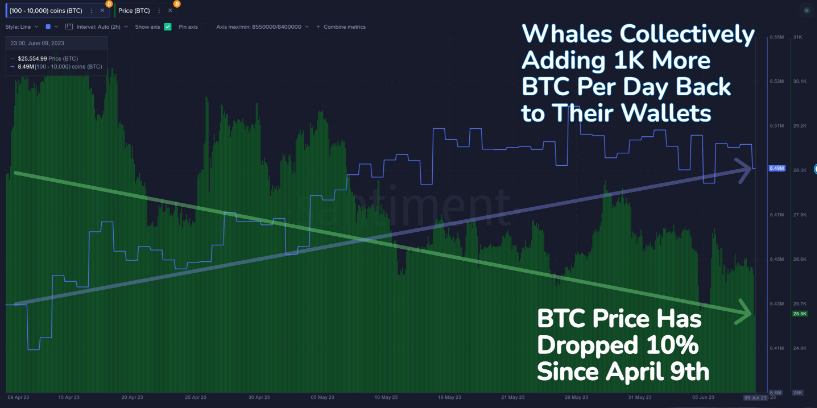

The price of bitcoin has dropped ten percent since April 9. But in that same time, whales holding between 100 and 10,000 BTC have accumulated an additional 57,578 BTC, analysis by Santiment reveals.

This divergence between the price of bitcoin and whale accumulation runs counter to previously observed trends. In the past, heightened whale accumulation has often coincided with bull runs or following a market low.

Whale Accumulation Watchers Anticipate BTC Price Rebound

Bitcoin whales are closely watched by market analysts and their behavioral patterns are often incorporated in price predictions.

But the current trend for the largest holders fattening up their wallets when the price of bitcoin is trending down doesn’t fit with previously observed patterns. Instead of buying while BTC is on the way up, since mid-April when Bitcoin hit its year-to-date high, whales have been stockpiling.

Have these wallets bought at the top for the first time? Or is the current downtrend only the precursor to an even more dramatic upswing?

Of course, if the rate of whale accumulation continues to rise, this in itself will have an impact on demand for BTC which could push the price up.

Bitcoin Dominance Surges to Two-Year High

Beyond whale accumulation, a recent surge in bitcoin dominance points toward the cryptocurrency’s status as a safe haven for investors in times of market volatility.

According to TradingView, bitcoin dominance currently sits at over 49%, its highest rate since April 2021. That means that nearly half of all the value locked in crypto is in the form of BTC.

One factor behind this recent spike is a parallel collapse in the price of major altcoins. With tokens like Solana and Polygon’s MATIC falling over 20% in a brutal Saturday morning crash, the relative stability of Bitcoin’s price provides refuge from much larger losses.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link

Be the first to comment