[ad_1]

Andreessen Horowitz (a16z) has released the second edition of its “State of Crypto” report. According to the venture capital firm, the crypto industry has steadily grown over the years, even as prices fluctuate.

The health of the crypto industry has been heavily debated in recent years. It is a complex question that cannot be determined by market prices alone. While market prices reflect the demand and supply of cryptocurrencies, they do not necessarily reflect the industry’s overall health.

To understand whether the crypto industry is “healthier” than market prices indicate, it is essential to examine various factors contributing to the industry’s health and growth.

What Makes the Industry Healthy?

One factor that suggests the crypto industry is healthier than market prices indicate is its growth and adoption in recent years. Cryptocurrencies like Bitcoin and Ethereum have become increasingly popular for investment, payment, and fundraising. Innovative technologies and business models have accompanied the crypto market’s development. Indeed, transforming traditional industries.

For example, blockchain technology that underlies cryptocurrencies has the potential to revolutionize various industries. Including finance, supply chain management, and healthcare. The decentralized nature of blockchain technology could enhance transparency, security, and efficiency in these industries. And, further, unlock new opportunities for innovation and growth.

Another factor that suggests the crypto industry is healthier than market prices indicate is the increasing participation from institutional investors and traditional financial institutions. In the past, the crypto market was mostly the domain of retail investors and enthusiasts. However, there has been a growing interest from institutional investors and financial institutions. Including such names as Goldman Sachs and Fidelity Investments.

This increasing interest from institutional investors could bring more stability and credibility to the crypto market. Institutional investors have more substantial resources and expertise in risk management. This could curb the volatility and unpredictability of the crypto market. Furthermore, the involvement of traditional financial institutions could provide more accessibility and legitimacy to cryptocurrencies. Thereby attracting more mainstream adoption and investment.

What Doesn’t Help the Industry?

However, despite the growth and adoption of cryptocurrencies, the crypto industry has faced challenges and criticisms. One such challenge is regulatory uncertainty. Cryptocurrencies operate in a regulatory gray area, with many countries needing clear guidelines and regulations to govern the industry. This lack of clarity could deter institutional investors and mainstream adoption. As they may perceive the crypto market as too risky and unpredictable.

Furthermore, the lack of regulatory clarity could lead to fraudulent activities and security concerns. In the past, several high-profile cases of cryptocurrency exchanges and ICOs (initial coin offerings) turned out to be fraudulent or hacked. Thus, resulting in severe losses for investors. Such incidents damage the reputation of the crypto industry and hurt investor confidence.

Another criticism of the crypto market is its volatility and lack of fundamental value. Critics argue that the crypto market is highly speculative and volatile and lacks the fundamental value traditional assets offer. Traditional assets, such as stocks and bonds, have underlying value based on the cash flows and earnings of the underlying companies. However, cryptocurrencies do not have underlying cash flows or earnings. This could make them more susceptible to speculation and price manipulation.

Despite these challenges and criticisms, the crypto industry continues to evolve and mature, with growing participation from institutional investors and traditional financial institutions. Many countries are also developing regulatory frameworks to govern the industry, which could enhance investor confidence and promote the industry’s long-term sustainability.

What’s the Final Verdict?

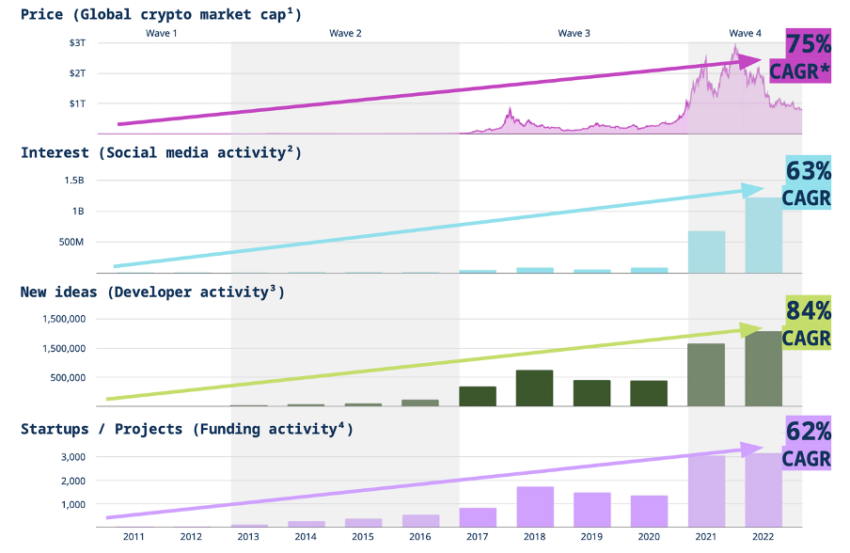

As the crypto market continues to find its footing in an ever-shaky climate, Andreessen Horowitz (a16z) released its second “State of Crypto” report. It dives into everything from blockchain activity to new technologies. But one theme that stands out is that blockchains are scaling.

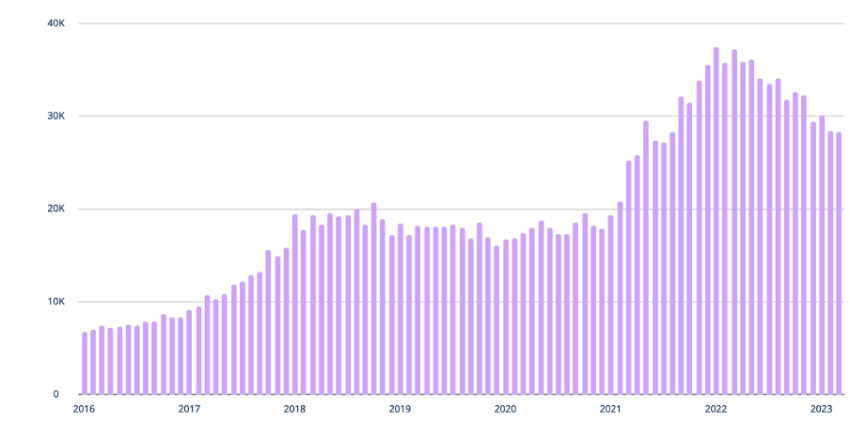

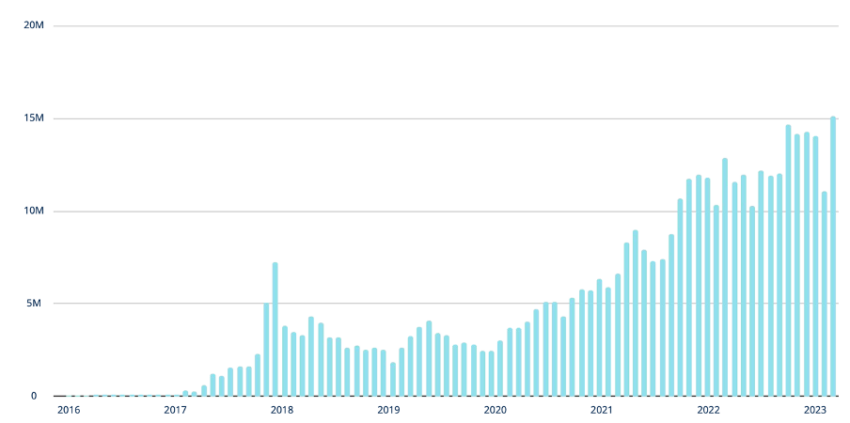

According to the venture capital firm, the crypto industry has steadily grown, even as prices fluctuate. The report highlights progress in the crypto industry, with more builders joining the industry than ever before.

Positive signs include accelerated academic research, the launch of new ambitious projects, and improvements in critical infrastructure (exemplified by Ethereum’s recent transition to energy-efficient “proof-of-stake”). This marks one of the most significant upgrades in open-source software development history.

Global market cap has grown at the rate of 75% CAGR since 2011, with social media activity by 63%, Developer activity by 84%, and funding activity by 62%.

In a discussion with BeInCrypto, team executives Daren Matsuoka, Eddy Lazzarin, Robert Hackett, and Stephanie Zinn stated:

“Our 2023 report aims to address the imbalance between the noise of fleeting price movements – and the data that tracks the signals that matter, including the durable progress of web3 technology. Overall, the report reflects a healthier industry than market prices may indicate and a steady cycle of development, product launches, and ongoing innovation.”

Web3 Shows Strength

While the report signals an overall positive outlook for the industry, it also highlights adverse events that might worry stakeholders. The report says that the headline-grabbing scandals and collapses of the past year have demonstrated the failure of centralized systems versus the open, resilient nature of decentralized infrastructure.

Nonetheless, a16z asserted strength for Web3, saying that Web3 is “more than a financial movement, it’s an evolution of the internet,” It advances the internet through “crypto computers, not crypto casinos.”

In conclusion, while market prices may not always reflect the health of the crypto sector, the industry’s growth and innovation are indicators of its potential for long-term success. The increasing adoption and participation from institutional investors and traditional financial institutions suggest that the crypto industry is healthier than market prices indicate.

Even so, it is essential to remain cautious and vigilant in assessing the risks and opportunities associated with cryptocurrencies and to take necessary precautions to protect one’s investments.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content.

[ad_2]

Source link

Be the first to comment