[ad_1]

Despite the much-hyped launch of Bitcoin ETFs and a relatively buoyant crypto market, venture capital investing in the sector declined in January. Moreover, there was an increase in the number of funding rounds but a decline in the total amount raised.

On February 5, industry research outlet Wu Blockchain released its January 2024 crypto venture capital report.

Venture Capital Funding Down

The report, which used RootData statistics, noted that there were a total of 113 publicly disclosed investment projects in the crypto venture capital space in January. This represents a month-on-month increase of 10.8% from 102 projects in December 2023.

It is also marginally higher than the 111 projects in January 2023, it reported.

However, the total fundraising amount in January was $650 million. This is a month-on-month decrease of 28.6% from $910 million in December 2023. Nevertheless, the figure is 3.2% higher than the $630 million raised in January 2023.

Decentralized finance (DeFi) represented the largest sector, with 19% of the total. The financing proportion of infrastructure projects was approximately 12%, and NTFs and GameFi also represented 12%.

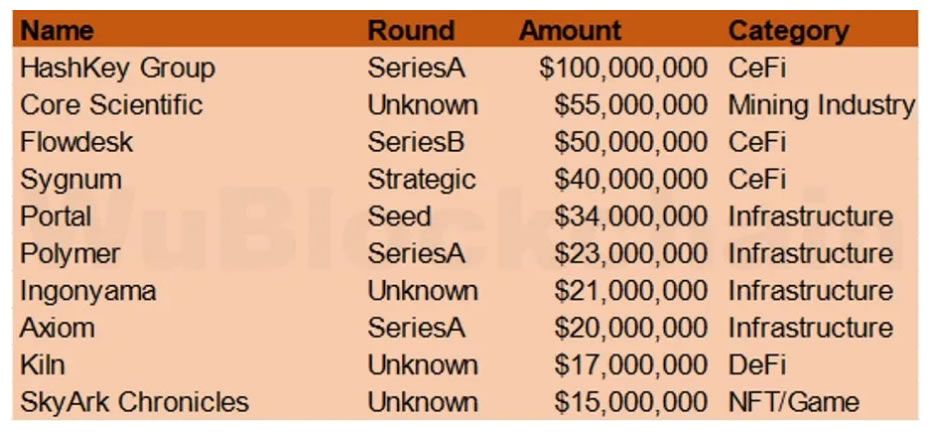

HashKey Group was the largest VC raise for the month. Its Series A funding round raised nearly $100 million with a pre-money valuation exceeding $1.2 billion.

Crypto mining company Core Scientific also announced the final results of its $55 million equity offering, which was oversubscribed.

Other notable VC raises for the month included market maker Flowdesk with $50 million in a Series B at a $250 million valuation. Crypto bank Sygnum also raised $40 million at a $900 million valuation, according to the report.

Read more: What’s the Relation Between Venture Capital Investment and Crypto Market Prices?

DeFi analytics platform DeFiLlama has a slightly different figure, with $460 million reportedly raised in January. However, it does not include centralized finance (CeFi) projects like Flowdesk.

Therefore, DeFiLlama’s total is 13% higher than the $407 million it reported for December crypto VC raises.

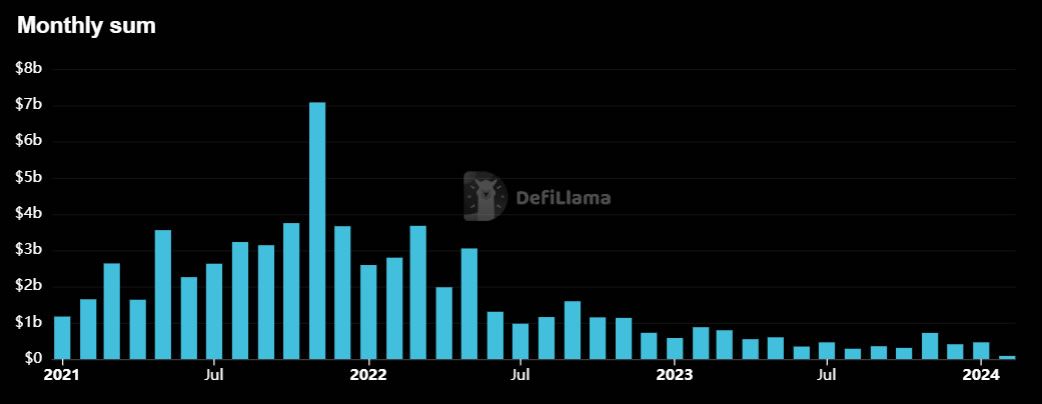

VC Funding Still Flat

Nevertheless, crypto venture funding remains relatively flat compared to the billion-dollar monthly highs in 2021 and 2022. There was a slight uptick at the end of 2023, but it has yet to fully take off again.

According to DeFiLlama, there have been a handful of notable projects raising funds so far in February. The largest of these is the crypto payments app Oobit, which raised $25 million on February 5.

Hybrid crypto exchange Cube raised $12 million on February 1, while layer-1 blockchain Nibiru raised the same amount on February 5. Web3 gaming platform Pixelmon also raised $8 million in a February 2 seed round.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link

Be the first to comment