[ad_1]

As the world grapples with a banking crisis on the brink of chaos, the Federal Reserve (Fed) has taken drastic measures to pump liquidity into the market. The initiative has led to an unexpected response from the crypto market, particularly Bitcoin.

Amidst rising interest rates and a string of bank bailouts, the Fed’s balancing act between tightening and loosening monetary policy has left many investors questioning the safety of their assets.

The Banking Crisis Goes Global

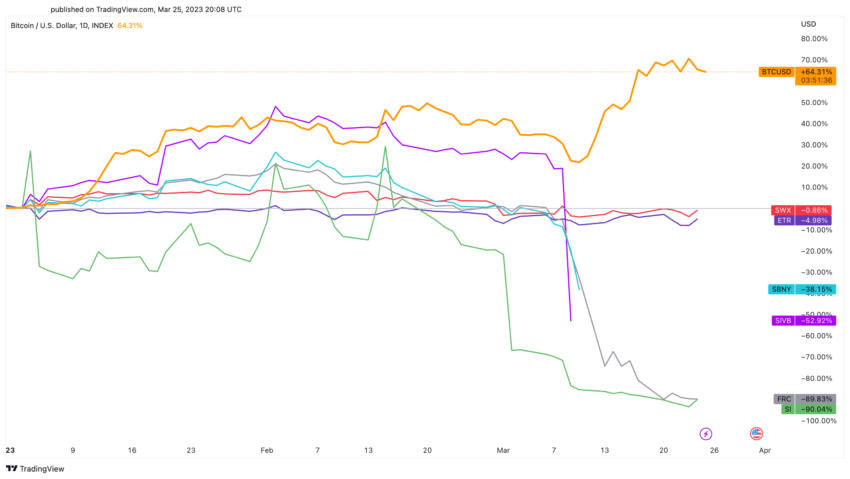

In the United States, multiple banks, including Silvergate, Silicon Valley Bank, Signature Bank, and First Republic Bank, have come under tremendous stress, requiring government or private market intervention. But the crisis has not been limited to the US.

European banks such as Credit Suisse and Deutsche Bank also struggle to stay afloat.

Governments and central banks worldwide have stepped in to mitigate the crisis to provide liquidity.

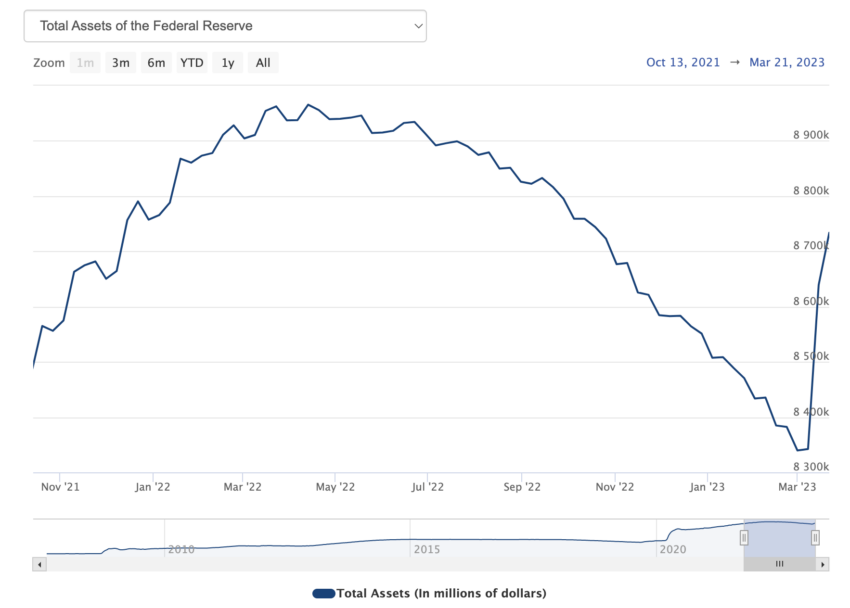

The Federal Reserve, the FDIC, and other organizations have thrown “monetary bazookas” at the beleaguered banks in the US. The move has seen the Fed’s balance sheet swell by $400 billion in just two weeks.

This rapid increase has effectively negated 64% of the progress made in quantitative tightening over the past year.

The market, however, remains uncertain about the Fed’s strategy. While interest rates have continued to rise, the massive liquidity injection has confused the market.

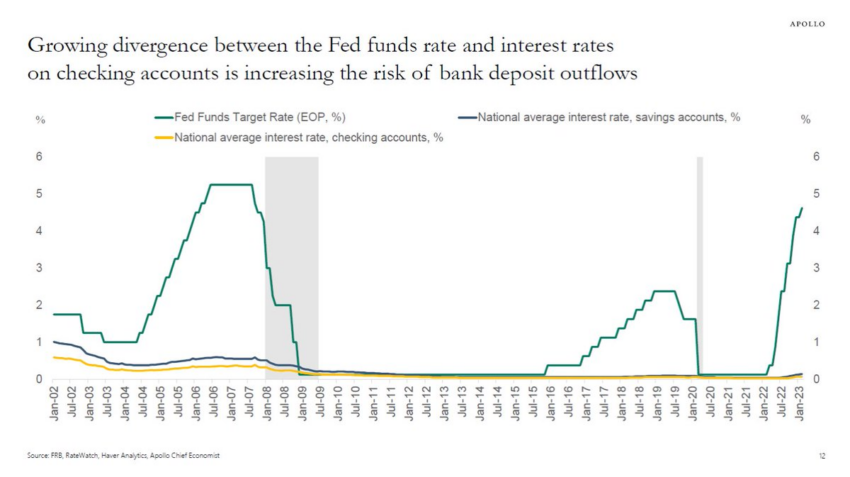

Torsten Slok, Partner and Chief Economist at Apollo, maintains that the spread between Fed Funds and interest rates on checking accounts is “the fundamental reason why money is being moved out of bank deposits.”

Slok believes that this growing divergence is “highly unusual compared to previous banking crises, where the source of instability has typically been credit losses.”

Bitcoin Thrives Amid Psychological Awakening

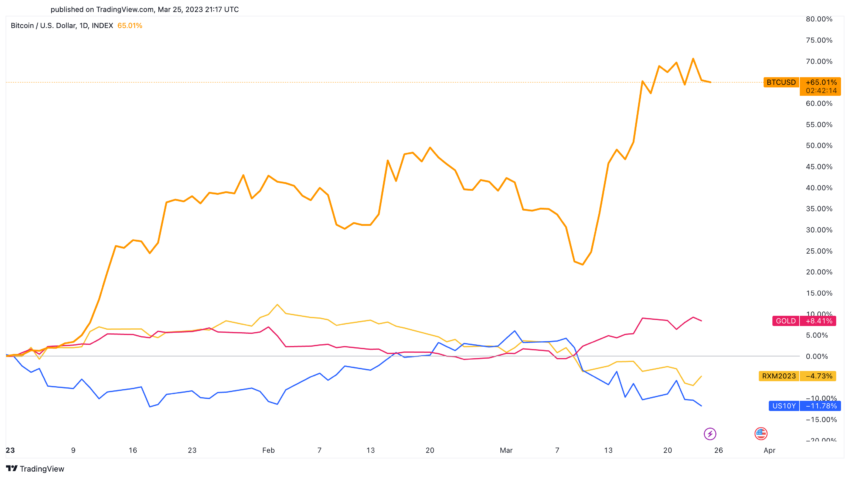

As a result of this uncertainty, many investors have turned to alternatives such as Bitcoin, gold, and real estate. The growing concerns about the safety of traditional banking have led to a “psychological awakening” in the Bitcoin community.

This, combined with the desire for higher yields, has led to an influx of funds into money market funds and other non-deposit assets, putting further stress on the banking system.

Economist Nouriel Roubini affirms that depositors have begun to realize “they can earn 4% on safe short-term T-Bills while they get close to 0% on bank deposits.” This serves as a primary driver for ongoing bank runs.

The era of banks benefiting from free deposits is coming to a close, according to “Dr. Doom.” Roubini concluded that the responsiveness of deposits to interest rate changes is significantly intensifying.

Despite the dire situation, experts believe that the banking crisis will ultimately be resolved, with governments and central banks working tirelessly to prevent bank failures both in the US and internationally.

The President of the European Central Bank, Christine Lagarde, said at a press conference after the announcement of a 0.5 percentage point hike in deposit interest rates:

“Under the baseline, the economy looks set to recover over the coming quarters. Industrial production should pick up as supply conditions improve further, confidence continues to recover, and firms work off large order backlogs. Rising wages and falling energy prices will partly offset the loss of purchasing power that many households are experiencing as a result of high inflation. This, in turn, will support consumer spending.”

Nonetheless, the efforts to stabilize the system will likely lead to other inflationary pressures and further food price increases.

In the meantime, investors are increasingly diversifying their portfolios and placing their trust in alternatives like Bitcoin. More than 4.28 million Bitcoin wallets have been created on the network, holding a balance of 0.1 BTC or more.

As the world continues to navigate this financial minefield, it’s clear that a younger generation is more inclined to rely on software-driven solutions over human-led systems.

Investors must closely monitor central bank responses. Likewise, developments in Europe and other affected regions can shed some light as the global banking crisis unfolds.

The ongoing trend of a debt-based economy and a fractional reserve banking system suggests that, in the long term, alternative assets like Bitcoin may emerge as the biggest winners.

Disclaimer

All the information contained on our website is published in good faith and for general information purposes only. Any action the reader takes upon the information found on our website is strictly at their own risk.

[ad_2]

Source link

Be the first to comment