[ad_1]

A World Federation of Exchanges (WFE) survey has revealed that fewer than 50% of respondents were willing to host crypto assets without safer vehicles like exchange-traded funds (ETFs). Of the 29 surveyed, only 12 out of 29 supported crypto, with seven out of the remaining 17 interested in offering crypto in the future.

According to Dr Pedro Gurrola-Perez, head of research at the WFE, demand for crypto products and services is growing. But cybersecurity risks and unclear regulations make a crypto a bridge too far for some exchanges.

WFE Says ETFs Will Improve Global Crypto Credibility

According to WFE CEO Nandini Sukumar, recent moves to bring crypto to market through exchange-traded products (ETP) will give the space much-needed momentum. Already, at least seven US firms have applied to launch an exchange-traded fund tracking the price of Bitcoin (BTC).

“As this industry and market matures, coming in to the mainstream of financial markets, the exchange-traded model, which places investor trust, transparency, accountability and investor protection at the heart of the platform, will gain further momentum,” she said.

The crypto industry moved one step closer to the approval of a spot Bitcoin ETF after a US court agreed the US Securities and Exchange Commission’s (SEC) appraisal of the underlying market was inconsistent with its earlier approval of an ETF based on Bitcoin futures. As a result, the SEC could refuse Grayscale’s application on new grounds, but, by and large, experts predict it will approve an ETF within the next five to six months.

Read our guide on the cryptocurrency futures market here.

Several New Laws Must Come Into Play for Exchange Participation

In a recent interview with BeInCrypto, John Palmer, the President of Cboe Digital, a new exchange focused on digital assets, said winning customer trust was an important part of progress. The company operates a two-tier exchange system with a broker and clearinghouse that ensures transparent trades.

In a direct investor model like the one offered by major crypto exchanges, the company often performs both functions and can theoretically trade against its customers. This practice is illegal under US exchange laws.

On Monday, the London Stock Exchange Group announced its intention to launch a digital exchange business to trade tokenized assets internationally. The new exchange would be unrelated to LSE’s core business and would comply with digital exchange regulations in all jurisdictions it will operate.

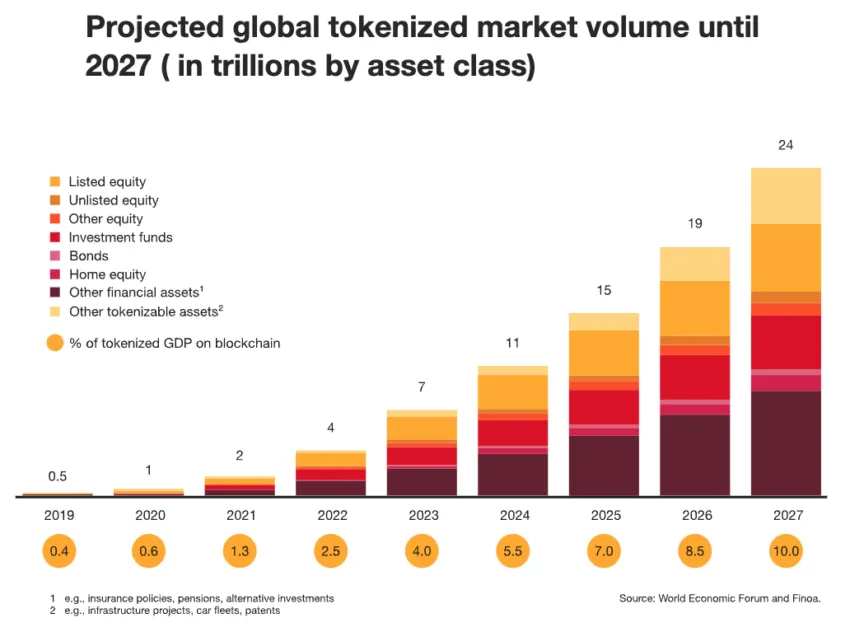

But exchange rules are only one part of the puzzle. Given moves by banks like Goldman Sachs, Citi, and Deutsche Bank to speed up transfers of tokenized assets, rules on fractionalized ownership will soon come into play.

Confused? Read our primer on blockchain tokenization here.

According to Mitch DiRaimondo of property veterans SteelWave, US laws on property rights are still stuck in the dark ages. Asset transfers over blockchains will not benefit from increased liquidity unless ownership models adapt quickly.

Got something to say about traditional exchanges not being willing to host global crypto assets or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

[ad_2]

Source link

Be the first to comment