[ad_1]

The trustee in charge of the Mt. Gox crypto bankruptcy estate has reportedly started repaying victims of the exchange’s hack in 2014. Several users of the subreddit ‘mtgoxinsolvency’ report Japanese yen deposits into their PayPal accounts.

Those who used the lump sum option posted screenshots of PayPal’s email confirming the deposit. It appears that those expecting Bitcoin (BTC) and bank reimbursements have not received any funds.

Mt. Gox Creditor Repayments Encounter Snags

Some customers seemed confused by the amounts they received. Some said they got less than expected, while others were apparently paid twice in error.

The Mt. Gox Rehabilitation Trustee, Nobuaki Kobayashi, has reportedly told those who received a double payment in error to return the spurious funds. Kobayashi said in November that he had received funds from the liquidation of $47 million worth of the bankrupt exchange’s assets.

At the time, he extended the repayment deadline from October 31, 2023, to October 31, 2024, with the permission of the Tokyo District Court.

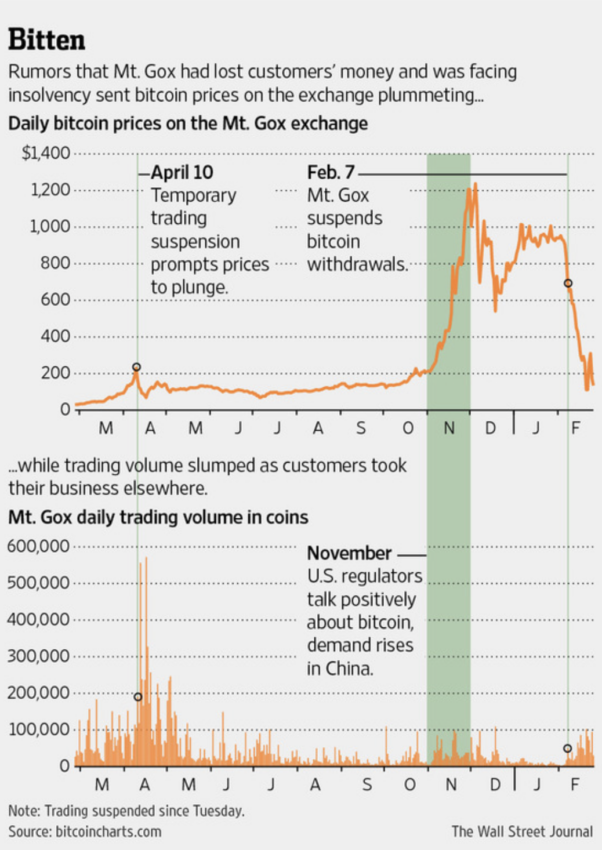

Mt. Gox was a Japanese Bitcoin exchange that collapsed in 2014 after it said it lost almost 750,000 customers’ BTC and 100,000 of its own BTC. Its former CEO, Mark Karpeles, was charged with embezzlement and aggravated breach of trust. He was found not guilty on most charges.

In 2018, Kobayashi claimed he had secured enough funds to repay creditors. Overall, around 99% of creditors agreed to his plan, which was ratified on November 16, 2021.

Read more: 13 Best Bitcoin Exchanges and Platforms in 2024

How Crypto Bankruptcies Have Changed

The apparent repayments come almost ten years after Mt. Gox filed for bankruptcy. The subreddit revealed the frustration of some of its creditors, who lamented the long wait times.

In comparison, FTX Trading, which collapsed last year following a lengthy fraud carried out by its then-CEO, Sam Bankman-Fried, recently filed a reorganization plan to repay creditors. The filing came about 13 months after the exchange’s original application for Chapter 11 bankruptcy.

Last month, US Judge Martin Glenn cleared the creditor repayment plan of crypto lender Celsius, which filed for bankruptcy in July 2022. The funds would reportedly come from cryptocurrency and equity in a new crypto mining company.

Crypto lender BlockFi said it would return customer funds 11 months after its original filing.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

Do you have something to say about the Mt. Gox creditor repayment plan, how long a crypto bankruptcy takes in comparison nowadays, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

[ad_2]

Source link

Be the first to comment